Expert Guide: Navigating SSI Benefits 2025

This expert guide provides crucial insights into navigating Supplemental Security Income (SSI) benefits for 2025, detailing eligibility, application processes, and strategies to maximize your financial support.

Are you wondering about the future of your financial security or that of a loved one? Understanding the intricacies of Supplemental Security Income (SSI) can be a challenging, yet vital, endeavor. This SSI Benefits 2025 Guide aims to demystify the process, offering clear, actionable insights to help you navigate the system effectively. We’ll explore what SSI is, who it’s for, and how you can prepare for the changes and opportunities that 2025 may bring.

Understanding Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a federal income supplement program funded by general tax revenues, not by Social Security taxes. It’s designed to help aged, blind, and disabled people who have little or no income. The program provides cash to meet basic needs for food, clothing, and shelter. Eligibility for SSI is not based on prior work history, unlike Social Security Disability Insurance (SSDI), which makes it a crucial safety net for many vulnerable individuals in the United States.

For 2025, while the core mission of SSI remains steadfast, specific adjustments to benefit amounts, income limits, and resource thresholds are anticipated. These changes are typically influenced by cost-of-living adjustments (COLAs) and legislative updates, reflecting economic shifts and the evolving needs of the population. Staying informed about these potential modifications is paramount for current recipients and prospective applicants alike.

Who is eligible for SSI?

Eligibility for SSI hinges on several key criteria related to age, disability, and financial need. Understanding these requirements is the first step in determining if you or someone you know qualifies for this vital assistance.

- Age: You must be 65 or older.

- Blindness: You must meet the Social Security Administration’s definition of blindness.

- Disability: You must meet the Social Security Administration’s definition of disability, which generally means you cannot engage in substantial gainful activity due to a medically determinable physical or mental impairment that has lasted or is expected to last for a continuous period of not less than 12 months or result in death.

Beyond these primary conditions, financial eligibility plays a significant role. Applicants must have limited income and resources. Income includes earnings, pensions, and other benefits, while resources encompass cash, bank accounts, stocks, and other assets that can be converted to cash. Certain assets, such as your primary residence and one vehicle, are typically excluded from resource calculations.

The SSI program is a lifeline for millions, providing essential financial support to those who need it most. By familiarizing yourself with its foundational principles and anticipated 2025 updates, you can better prepare for the application process and ensure you receive the benefits you are entitled to.

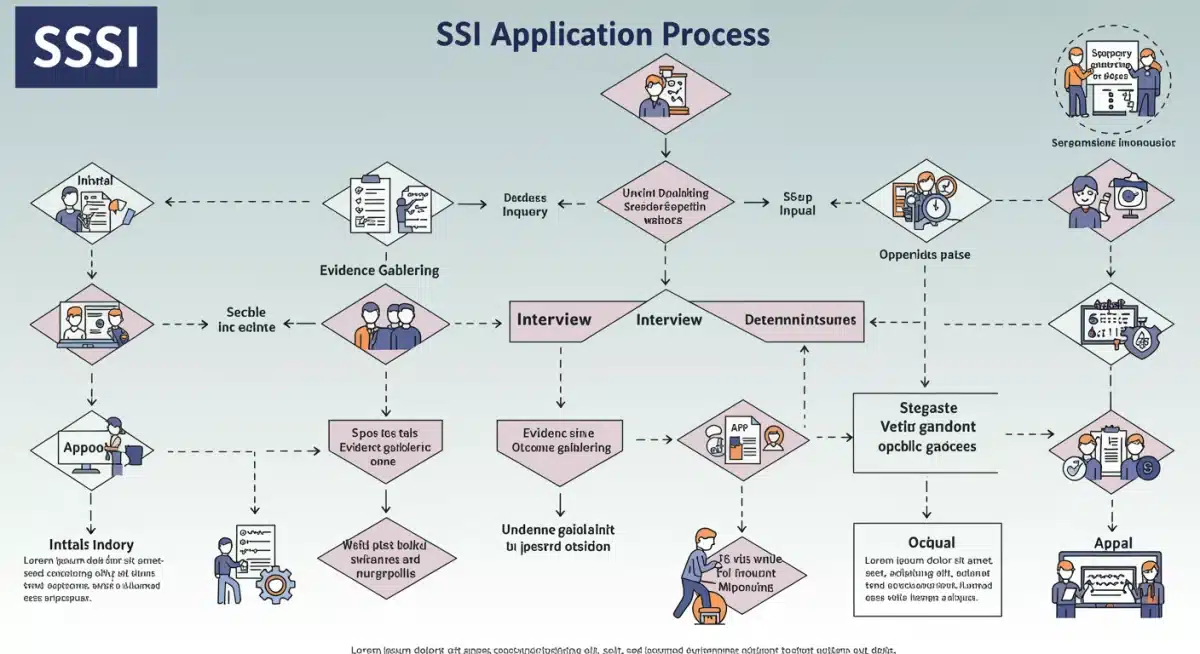

Navigating the SSI Application Process for 2025

Applying for Supplemental Security Income can seem daunting, but with a clear understanding of the steps involved, the process becomes much more manageable. The Social Security Administration (SSA) has a structured application pathway designed to assess eligibility thoroughly. Being prepared with the right documentation and information is key to a smooth application.

The application typically begins with an initial inquiry, which can often be done online, by phone, or in person at a local SSA office. This initial contact helps determine if you meet the basic non-financial criteria. Following this, you will need to complete a detailed application that covers your income, resources, and medical condition if applying due to disability or blindness.

Essential documents for your application

Gathering all necessary documents before starting your application can significantly expedite the process. Missing information is a common cause of delays. Here’s a list of typical documents you’ll need:

- Birth certificate or other proof of age.

- Social Security card.

- Proof of U.S. citizenship or lawful alien status.

- Income and resource information (e.g., bank statements, pay stubs, property deeds).

- Medical records if applying for disability or blindness (e.g., doctor’s reports, hospital records, medication lists).

- Work history information (if applicable).

It is crucial to provide accurate and complete information. Any discrepancies or omissions could lead to a denial of benefits or prolong the decision-making period. The SSA may also request additional information or schedule a consultative examination with one of their doctors if your medical records are insufficient to make a disability determination. Patience and thoroughness are your allies throughout this process.

Once your application is submitted, the SSA will review your financial and medical information. This review can take several months. If approved, you will begin receiving benefits. If denied, you have the right to appeal the decision, which involves multiple stages, including reconsideration, a hearing by an administrative law judge, and potentially further appeals to the Appeals Council and federal court. Understanding each stage of the application and appeal process is vital for successfully securing SSI benefits.

Income and Resource Limits: What to Expect in 2025

The financial criteria for SSI eligibility are strict and revolve around income and resource limits. These limits are subject to annual adjustments, and understanding the anticipated changes for 2025 is critical for both new applicants and current beneficiaries. Staying within these thresholds is paramount to maintaining eligibility.

Income, for SSI purposes, includes almost anything you receive that can be used to meet your needs for food or shelter. However, not all income counts toward the limit. The SSA has specific rules about what is considered countable income and what is excluded. For instance, a portion of earned income is often disregarded, and certain types of assistance are not counted. Resources are assets you own, such as cash, bank accounts, land, and vehicles. Like income, not all resources are counted toward the limit.

Key exclusions and disregards

The SSA applies various exclusions and disregards when calculating your countable income and resources. These are designed to ensure that people can still work or have essential assets without losing their benefits entirely.

- Earned Income Disregard: A significant portion of your earned income is typically not counted, encouraging work.

- General Income Exclusion: A small amount of unearned income is also disregarded.

- Resource Exclusions: Your primary residence, one vehicle (regardless of value if used for transportation), and certain household goods are generally not counted.

- Plan to Achieve Self-Support (PASS): This allows disabled individuals to set aside income and resources for a work goal.

For 2025, it is expected that the federal benefit rate (FBR), which is the maximum federal SSI payment, will increase due to a Cost-of-Living Adjustment (COLA). This adjustment will also likely lead to corresponding changes in the income and resource limits. While the exact figures are usually announced late in the year prior, it is wise to monitor official SSA announcements. Planning your finances with these potential changes in mind can prevent unexpected eligibility issues.

Careful management of your finances and a thorough understanding of what counts as income and resources are essential. If your income or resources exceed the limits, even temporarily, it could affect your SSI payments. Consulting with an SSA representative or a benefits counselor can provide personalized guidance on how these rules apply to your specific situation, ensuring you remain compliant and receive the maximum possible benefit.

Maximizing Your SSI Benefits: Insider Knowledge for 2025

Receiving SSI benefits is about more than just getting a monthly check; it’s about understanding how to optimize your financial situation within the program’s guidelines. For 2025, having insider knowledge can make a significant difference in maximizing your benefits and navigating potential pitfalls. Effective planning and proactive communication with the Social Security Administration are key strategies.

One crucial aspect of maximizing benefits involves understanding the interplay between SSI and other forms of income or assistance. For instance, while some income reduces your SSI payment dollar-for-dollar, other types of income or support may have less of an impact or even be entirely excluded. Knowing these distinctions can help you make informed decisions about employment, gifts, or other financial inflows.

Strategies for optimizing your payments

Several strategies can help you make the most of your SSI benefits. These often involve understanding the nuances of the program and how different financial situations are treated.

- Reporting Changes Promptly: Always report changes in income, resources, living arrangements, or marital status to the SSA immediately. Delays can lead to overpayments that you might have to repay.

- Utilizing Work Incentives: If you are able to work, explore SSA’s work incentives, such as the Plan to Achieve Self-Support (PASS) or Impairment-Related Work Expenses (IRWE), which allow you to keep more of your earnings without reducing your benefits.

- Understanding In-Kind Support and Maintenance (ISM): If someone else provides you with food or shelter, it can reduce your SSI. However, there are ways to structure this support to minimize its impact on your benefits.

Another important consideration for 2025 is staying updated on any changes to state supplementary payments. Many states provide an additional payment to SSI recipients, and these amounts can vary. Being aware of these state-specific benefits can add to your overall financial support. Additionally, exploring options for managing resources, such as establishing an ABLE account for individuals with disabilities, can help you save money without impacting your SSI eligibility. These accounts allow eligible individuals to save money without it counting against their SSI resource limit, offering a valuable tool for financial independence.

The Role of Medical Reviews and Continuing Disability Reviews

For those receiving SSI based on disability or blindness, periodic medical reviews, also known as Continuing Disability Reviews (CDRs), are an integral part of the program. These reviews are conducted by the Social Security Administration to determine if your medical condition has improved to the point where you are no longer considered disabled under their rules. Preparing for a CDR is just as important as preparing for your initial application.

The frequency of CDRs depends on the nature of your disability. If your condition is expected to improve, you might be reviewed more frequently (e.g., every 6-18 months). If improvement is possible but not expected, reviews might occur every 3 years. For permanent conditions, reviews are typically scheduled every 5-7 years. The SSA will notify you by mail when it’s time for a review, so it’s critical to keep your contact information updated.

What to expect during a CDR

During a CDR, the SSA will request updated medical evidence from your doctors and other healthcare providers. They may also ask you to complete forms about your daily activities and any work you’ve done. The goal is to compare your current medical condition and functional abilities with those at the time of your last favorable decision.

- Medical Evidence: Provide all recent medical records, including doctor’s notes, test results, and treatment plans.

- Function Report: Accurately describe how your condition affects your daily life and activities.

- Work Activity: Report any work, even part-time or volunteer, and how your disability impacts your ability to perform it.

If the SSA determines that your medical condition has improved and you are no longer disabled, your SSI benefits could be terminated. However, you have the right to appeal this decision, similar to the initial application process. It is advisable to continue treatment and maintain thorough medical records, even if your condition appears stable. These records are your best defense during a CDR and are crucial for proving ongoing disability. Staying proactive and informed about the CDR process is essential for maintaining your SSI eligibility in 2025 and beyond.

Appeals and Overpayments: Protecting Your SSI Benefits

Even with careful planning, issues like benefit denials or overpayments can arise. Understanding how to navigate the appeals process and address overpayment notices is crucial for protecting your SSI benefits. These situations can be stressful, but knowing your rights and the steps to take can make a significant difference in the outcome.

If your initial application for SSI is denied, or if your benefits are terminated after a medical review, you have the right to appeal the decision. The appeals process typically involves several levels: reconsideration, a hearing by an Administrative Law Judge (ALJ), review by the Appeals Council, and finally, a review by a federal court. Each stage has specific deadlines, and missing these deadlines can jeopardize your appeal.

Dealing with overpayments

An overpayment occurs when the SSA pays you more SSI than you were due. This can happen for various reasons, such as timely reporting changes in income or living arrangements, or errors on the part of the SSA. When an overpayment occurs, the SSA will send you a notice explaining the amount of the overpayment, the reason for it, and your repayment options.

- Request a Waiver: You can ask the SSA to waive the overpayment if you were not at fault in causing it and if repayment would cause financial hardship.

- Request Reconsideration: If you believe the overpayment amount is incorrect or that you were not overpaid at all, you can request reconsideration.

- Repayment Plan: If the overpayment is valid and a waiver is denied, you can arrange a repayment plan with the SSA.

It’s vital to respond promptly to any overpayment notices. Ignoring them can lead to the SSA collecting the overpayment by reducing your future SSI benefits or even pursuing other collection methods. Seeking legal counsel or assistance from a benefits advocate can be highly beneficial when dealing with complex appeals or overpayment issues. These professionals can help you understand your options, gather necessary documentation, and represent your interests effectively, ensuring your SSI benefits are protected in 2025.

Future Outlook and Legislative Changes for SSI in 2025

The landscape of Supplemental Security Income is not static; it is continually shaped by economic factors, legislative actions, and societal needs. Looking ahead to 2025, understanding potential future outlooks and legislative changes is essential for beneficiaries and advocates alike. While predicting exact changes can be challenging, trends and ongoing discussions often provide valuable insights into what might be on the horizon for SSI.

One of the most anticipated annual changes is the Cost-of-Living Adjustment (COLA), which typically increases the federal benefit rate (FBR) to keep pace with inflation. The exact COLA for 2025 will be announced in late 2024, but it is expected to reflect economic conditions. Beyond COLA, there are ongoing discussions in Congress about potential reforms to the SSI program. These reforms often aim to modernize the program, address poverty, and improve access to benefits for eligible individuals.

Potential legislative reforms and advocacy efforts

Advocacy groups and policymakers frequently propose changes to SSI to make it more effective and responsive to the needs of its recipients. Some common areas of discussion include:

- Increasing Resource Limits: The current resource limits ($2,000 for individuals, $3,000 for couples) have not been updated for decades and are often cited as a barrier to financial stability.

- Modernizing Income Exclusions: Adjusting the amounts of income disregarded could allow beneficiaries to earn more without losing essential benefits.

- Streamlining the Application Process: Efforts to simplify the application and review processes aim to reduce administrative burdens and delays.

These potential legislative changes, while not guaranteed, highlight areas where the SSI program could evolve. Staying informed about these discussions through official government sources, reputable news outlets, and advocacy organizations is crucial. Engaging with these conversations, whether through contacting your representatives or participating in public forums, can also play a role in shaping the future of SSI. The goal is to ensure that SSI continues to serve as a strong safety net for those who rely on it, adapting to the needs of 2025 and beyond.

Understanding the political and economic forces that influence SSI ensures you are better prepared for any changes. By staying informed and engaged, you can help advocate for a stronger, more equitable SSI program that continues to provide vital support to millions of Americans.

| Key Aspect | Brief Description |

|---|---|

| Eligibility Criteria | Aged (65+), blind, or disabled with limited income and resources. |

| Application Process | Requires detailed financial and medical documentation with potential appeals. |

| Income & Resource Limits | Subject to annual COLA adjustments; specific exclusions apply to certain assets. |

| Maximizing Benefits | Prompt reporting, using work incentives, and understanding in-kind support are key. |

Frequently Asked Questions About SSI Benefits in 2025

SSI (Supplemental Security Income) is a needs-based program for aged, blind, or disabled individuals with limited income and resources, funded by general taxes. SSDI (Social Security Disability Insurance) is for those with a work history who have paid Social Security taxes.

Yes, it is highly anticipated that the federal benefit rate (FBR) for SSI will increase in 2025 due to the annual Cost-of-Living Adjustment (COLA). The exact percentage will typically be announced by the Social Security Administration in late 2024, reflecting inflation and economic factors.

Generally, your primary residence, one vehicle used for transportation, household goods and personal effects, and funds in an ABLE account (for eligible individuals) are not counted towards SSI resource limits. Specific rules apply, so it’s always best to check with the SSA.

The frequency of CDRs varies based on the likelihood of medical improvement. They can occur every 6-18 months for conditions expected to improve, every 3 years for possible improvement, or every 5-7 years for permanent conditions. The SSA notifies recipients by mail.

If you receive an overpayment notice, you should respond promptly. You can request a waiver if the overpayment wasn’t your fault and would cause hardship, or request reconsideration if you believe the amount is incorrect. You can also arrange a repayment plan with the SSA.

Conclusion

Navigating the complexities of Supplemental Security Income benefits for 2025 requires diligence, informed decision-making, and proactive engagement with the Social Security Administration. From understanding eligibility criteria and the application process to managing income and resources effectively, each step is crucial. Staying updated on COLA adjustments, potential legislative changes, and knowing how to handle reviews and appeals will empower you to secure and maintain the vital support SSI provides. This guide serves as a foundational resource, encouraging you to seek personalized advice and remain vigilant in advocating for your financial well-being.