Student Loan Refinancing 2026: Reduce Payments 10-15%

Student loan refinancing in 2026 presents a viable path for borrowers to secure lower interest rates and potentially decrease monthly payments by 10-15%, offering significant financial advantages and improved debt management.

Are your student loan payments weighing heavily on your monthly budget? In 2026, exploring student loan refinancing 2026 could be your most strategic move, potentially slashing your monthly obligations by a significant 10-15%.

Understanding Student Loan Refinancing in 2026

Student loan refinancing involves taking out a new loan to pay off one or more existing student loans. This new loan typically comes with a new interest rate and new terms, which can be highly beneficial for borrowers looking to reduce their financial burden. In 2026, the financial landscape continues to evolve, making it crucial to understand how current economic conditions and lender offerings can impact your refinancing opportunities.

The primary goal of refinancing is to save money over the life of the loan, often by securing a lower interest rate, or by extending the repayment period to reduce monthly payments. For many, the prospect of cutting payments by 10-15% is not just an aspiration but a tangible reality achievable through careful planning and selection of the right refinancing option.

Why Refinance Now? The 2026 Context

The economic climate in 2026, with its unique interest rate trends and lender competition, creates a ripe environment for refinancing. Lenders are continuously adjusting their terms to attract qualified borrowers, which can translate into more favorable rates for you. Staying informed about these trends is key to maximizing your savings.

- Lower Interest Rates: A primary driver for refinancing is the potential to secure an interest rate lower than your current one, leading to substantial savings.

- Reduced Monthly Payments: By extending the loan term or obtaining a lower rate, you can significantly decrease your monthly outlay.

- Simplified Payments: Consolidating multiple loans into one can streamline your finances, making it easier to manage payments.

- Release of Cosigner: Refinancing can sometimes allow for the release of a cosigner, relieving them of their financial obligation.

Ultimately, understanding the nuances of student loan refinancing in 2026 empowers you to make informed decisions that align with your long-term financial goals. It’s about taking control of your debt and optimizing your repayment strategy.

Eligibility Requirements for Student Loan Refinancing

Before diving into the application process, it’s essential to assess your eligibility for student loan refinancing. Lenders in 2026 have specific criteria they use to evaluate potential borrowers, and meeting these requirements is paramount to securing the best possible rates and terms. Understanding these factors beforehand can save you time and improve your chances of approval.

Key factors that lenders consider include your credit score, income, and debt-to-income ratio. While these may seem daunting, many borrowers find that a solid financial history and a stable income are strong indicators of their ability to repay a refinanced loan.

Credit Score and Financial Health

Your credit score is a critical component of the refinancing application. Lenders typically look for a strong credit history, indicating responsible financial behavior. A higher credit score generally translates to more favorable interest rates. If your credit score isn’t where you’d like it to be, taking steps to improve it before applying can significantly impact your refinancing outcome.

Beyond your credit score, lenders also scrutinize your income and employment history. They want to ensure you have a stable source of income that can comfortably cover your new monthly payments. A low debt-to-income ratio, meaning your monthly debt payments are low relative to your income, also signals financial stability.

- Good to Excellent Credit Score: Aim for a score of 670 or higher; scores above 740 are often considered excellent.

- Stable Income and Employment: Lenders prefer a consistent job history and sufficient income to cover expenses.

- Low Debt-to-Income Ratio: A DTI below 43% is generally favorable, showing you can manage existing debt.

- Graduation and Loan Status: Most lenders require you to have graduated and be current on your existing loan payments.

Meeting these eligibility requirements is the first step towards a successful refinancing journey. Even if you don’t meet all criteria perfectly, some lenders offer options for cosigners, which can bolster your application.

Comparing Lenders and Loan Offers in 2026

Once you understand your eligibility, the next crucial step in student loan refinancing in 2026 is to compare various lenders and their loan offers. The market is competitive, and rates can vary significantly, so a thorough comparison can lead to substantial long-term savings. Don’t settle for the first offer you receive.

It’s not just about the interest rate; you also need to consider loan terms, repayment options, and any fees associated with the new loan. A holistic view will help you choose the best refinancing partner for your specific financial situation.

Comparing pre-qualified rates from multiple lenders without impacting your credit score is a smart strategy. Many online platforms allow you to do this quickly and efficiently, giving you a clear picture of what you qualify for.

Key Factors for Lender Comparison

When evaluating different lenders, look beyond just the advertised interest rates. Consider the type of interest rate offered (fixed vs. variable), the available repayment terms, and any fees. A fixed rate provides payment stability, while a variable rate might start lower but can fluctuate.

- Interest Rates (Fixed vs. Variable): Understand the implications of each on your monthly payments and overall cost.

- Loan Terms: Shorter terms mean higher monthly payments but less interest paid; longer terms reduce monthly payments but increase total interest.

- Fees: Check for origination fees, application fees, or prepayment penalties, which can add to the overall cost.

- Customer Service and Reputation: Read reviews and assess the lender’s reputation for support and responsiveness.

By carefully comparing these factors, you can identify the lender that offers the most advantageous terms for your student loan refinancing needs in 2026. This diligent approach ensures you make a choice that truly benefits your financial future.

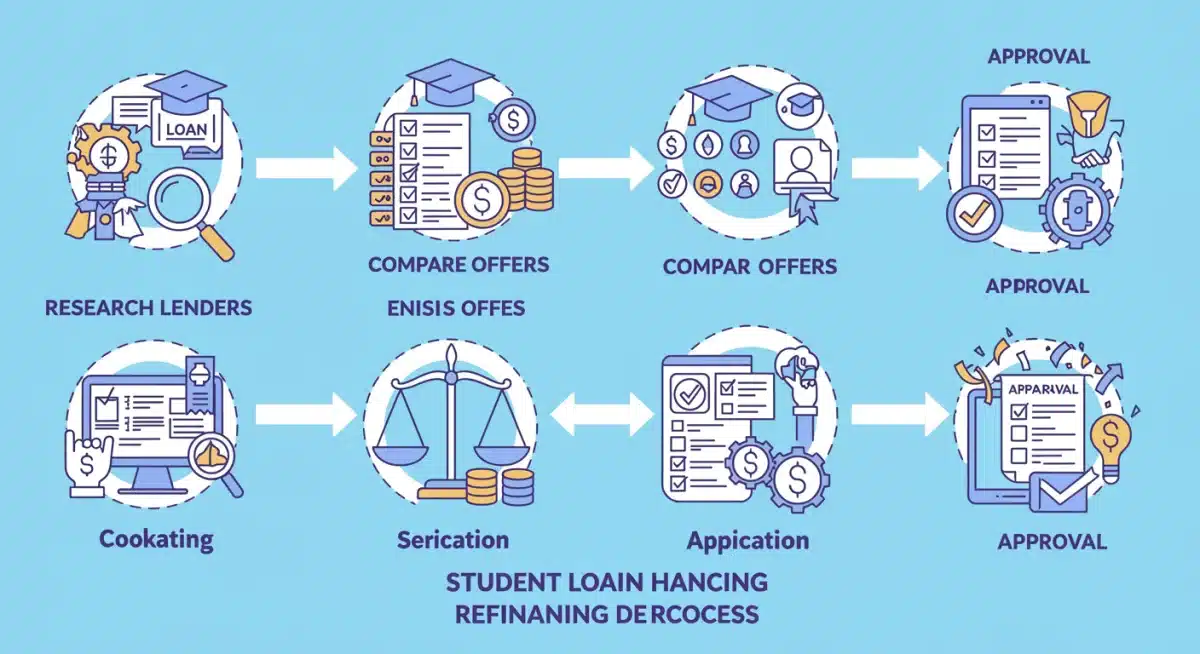

The Application Process: Step-by-Step Guide

Navigating the student loan refinancing application process in 2026 can seem complex, but breaking it down into manageable steps makes it straightforward. Once you’ve compared lenders and chosen the best option, you’ll need to gather documentation and complete the application accurately. This guide will help you through each stage, ensuring a smooth experience.

The key to a successful application is preparedness. Having all your financial information readily available will expedite the process and prevent unnecessary delays. Remember, precision and honesty in your application are paramount.

Gathering Required Documents

Before you even start filling out forms, compile all necessary documents. This typically includes proof of identity, income verification, and details about your existing student loans. The more organized you are, the easier the application will be.

- Proof of Identity: Government-issued ID, such as a driver’s license or passport.

- Income Verification: Pay stubs, tax returns, or employment verification letters.

- Student Loan Statements: Account numbers, current balances, and interest rates for all loans you wish to refinance.

- Proof of Graduation: Transcripts or diploma may be requested by some lenders.

After submitting your application, the lender will review your information and conduct a hard credit inquiry. This inquiry will temporarily impact your credit score, but the long-term benefits of refinancing often outweigh this short-term effect. Be prepared to answer any follow-up questions from the lender.

Upon approval, you’ll receive a loan offer detailing the new interest rate, terms, and monthly payments. Carefully review this offer before accepting to ensure it aligns with your expectations and financial goals. Once accepted, the new lender will disburse funds to pay off your old loans, and you’ll begin making payments to your new lender.

Maximizing Your Savings: Strategies for 2026

Achieving a 10-15% reduction in monthly payments through student loan refinancing in 2026 isn’t just about finding a lower interest rate; it’s also about employing smart strategies to maximize your savings. Every decision, from choosing a fixed versus variable rate to selecting your repayment term, plays a role in your long-term financial outcome.

Beyond the initial refinancing, ongoing financial discipline and strategic repayment can further enhance your savings. It’s a continuous process of managing your debt effectively to achieve financial freedom sooner.

Strategic Repayment Approaches

One powerful strategy is to make extra payments whenever possible. Even small additional contributions can significantly reduce the principal balance, thereby cutting down the total interest paid over the life of the loan. Consider setting up automatic payments to ensure consistency and possibly qualify for an interest rate discount offered by some lenders.

Another approach is to choose a shorter loan term if your budget allows. While this means higher monthly payments, it drastically reduces the amount of interest you pay over time. For example, opting for a 5-year loan instead of a 10-year loan can save you thousands in interest, even with a slightly higher monthly commitment.

- Make Extra Payments: Direct any extra income towards your principal balance to reduce total interest.

- Choose Shorter Terms: If affordable, a shorter repayment period saves significant interest.

- Automate Payments: Ensures on-time payments and may qualify you for rate discounts.

- Re-evaluate Annually: Periodically check rates to see if further refinancing could yield more savings.

By implementing these strategies, you’re not just refinancing; you’re actively managing your debt to achieve optimal financial health. The goal is to pay off your student loans efficiently and effectively, freeing up your finances for other life goals.

Potential Risks and Considerations

While student loan refinancing offers significant benefits, it’s crucial to be aware of the potential risks and considerations involved, especially when navigating the financial landscape of 2026. Understanding these aspects will help you make a fully informed decision that protects your financial well-being.

Refinancing federal student loans into a private loan, for instance, can mean losing access to certain federal protections that might be invaluable in times of financial hardship. Weighing these trade-offs is a critical part of the decision-making process.

Loss of Federal Loan Protections

One of the most significant risks when refinancing federal student loans is the forfeiture of federal benefits. These benefits include income-driven repayment plans, generous deferment and forbearance options, and potential loan forgiveness programs. Private lenders typically do not offer these same protections, which could leave you vulnerable if you face unexpected financial challenges.

For example, if you lose your job or experience a medical emergency, federal loan forbearance or deferment can temporarily pause your payments without accruing interest in some cases. Private loans usually have stricter forbearance policies, if they offer them at all.

- Forfeiture of Income-Driven Repayment (IDR) Plans: Federal IDR plans adjust payments based on your income and family size.

- Loss of Deferment and Forbearance Options: Federal loans offer more flexible options to temporarily pause payments.

- No Access to Federal Loan Forgiveness Programs: Public Service Loan Forgiveness (PSLF) and other programs are only for federal loans.

- Variable Rate Risks: While potentially starting lower, variable rates can increase over time, raising your monthly payments.

Before committing to student loan refinancing in 2026, carefully evaluate whether the potential savings outweigh the loss of these federal protections. For some, the stability and safety nets of federal loans are more valuable than a slightly lower interest rate from a private lender. Always consider your personal financial stability and future career outlook.

The Future of Student Loan Refinancing: 2026 Outlook

As we look ahead to the remainder of 2026, the landscape of student loan refinancing continues to evolve, influenced by economic trends, regulatory changes, and lender innovation. Staying abreast of these developments is vital for anyone considering refinancing their student loans, ensuring they can seize the most opportune moments and secure the best possible terms.

The financial market is dynamic, and what holds true today might shift tomorrow. Therefore, a forward-thinking approach, coupled with continuous monitoring of financial news, will empower you to make timely and effective decisions regarding your student debt.

Anticipated Trends and Opportunities

One major trend expected to continue in 2026 is the increasing personalization of loan products. Lenders are leveraging advanced analytics to offer more tailored interest rates and repayment plans based on individual borrower profiles. This means that a strong credit history and stable income could unlock even more competitive offers.

Furthermore, digital platforms are making the refinancing process more accessible and efficient. Online lenders are likely to continue streamlining applications, offering quick pre-qualification checks, and providing robust customer support through digital channels. This ease of access can encourage more borrowers to explore their refinancing options.

- Increased Personalization: Expect more customized loan offers based on individual financial data.

- Digital Evolution: Continued advancements in online application processes and digital customer service.

- Regulatory Environment: Potential shifts in federal or state regulations could impact refinancing terms.

- Interest Rate Volatility: Stay alert to changes in the Federal Reserve’s policies, which influence overall interest rates.

For those considering student loan refinancing in 2026, the outlook presents both opportunities and challenges. By remaining informed about market conditions and potential regulatory changes, you can strategically position yourself to achieve significant savings and gain greater control over your financial future. Proactive engagement with the refinancing market will be your strongest asset.

| Key Point | Brief Description |

|---|---|

| Eligibility Check | Assess credit score, income, and debt-to-income ratio to qualify for favorable rates. |

| Lender Comparison | Compare interest rates, terms, and fees from multiple lenders before committing. |

| Federal Protections | Be aware that refinancing federal loans into private loans means losing federal benefits like IDR. |

| Maximize Savings | Utilize strategies like extra payments and shorter terms to further reduce overall costs. |

Frequently Asked Questions About Student Loan Refinancing in 2026

The main benefit is the potential to secure a lower interest rate, which can significantly reduce your monthly payments and the total amount of interest paid over the life of the loan. Many borrowers aim for a 10-15% reduction in monthly payments.

Yes, applying for refinancing typically involves a hard credit inquiry, which can temporarily lower your credit score by a few points. However, consistent on-time payments on your new loan can help improve your score over time.

Yes, you can refinance both federal and private student loans. However, be aware that refinancing federal loans into a private loan means forfeiting federal protections like income-driven repayment plans and loan forgiveness programs.

While requirements vary by lender, a good to excellent credit score, typically above 670, is often needed to qualify for competitive refinancing rates. Higher scores usually unlock the best offers.

Most reputable lenders do not charge application or origination fees for student loan refinancing. However, it’s always wise to carefully review the loan terms and conditions for any hidden fees or prepayment penalties before signing.

Conclusion

The journey of student loan refinancing in 2026 presents a compelling opportunity for borrowers seeking financial relief and greater control over their debt. By diligently assessing eligibility, comparing lender offers, meticulously navigating the application process, and implementing strategic repayment methods, you can realistically achieve a 10-15% reduction in your monthly payments. While the allure of lower rates is strong, it is equally important to weigh the potential loss of federal protections against these savings. Ultimately, an informed and proactive approach will empower you to make the best decision for your unique financial circumstances, paving the way for a more stable and manageable financial future.